Fronius has been rated Australia’s most popular residential inverter brand by the nation’s solar installers with a survey conducted by market analyst Solar Nerds revealing that more than one quarter of installers prefer to use the Austrian manufacturer’s products.

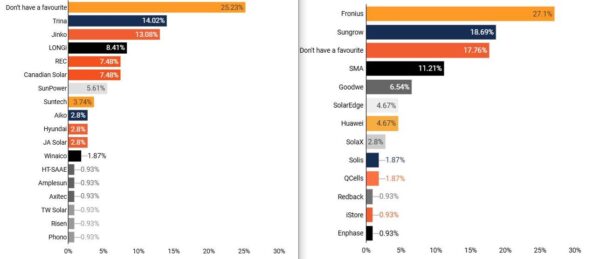

The survey, which canvassed the opinions of more than 250 solar installers from around the country, shows that 27.1% of respondents prefer to use Fronius Inverters.

Inverters from Chinese manufacturer Sungrow attracted the support of 18.69% of installers but in a blow for manufacturer loyalty, another 17.76% said they had no preference when it came to which brand they work with.

The lack of brand loyalty was even more pronounced with solar panels and battery energy storage systems with 25.23% of installers saying they don’t have a favourite solar panel to work with while 23.26% said the same about battery systems.

Image: Solar Nerds

Chinese manufacturing major Trina was the most popular of the solar panels with 14.02% of installers preferring to work with them, ahead of Jinko (13.08%) and Longi (8.41%).

Solar Nerds said Sungrow (20.56%) and Tesla (18.69%) were popular battery choices with BYD (8.41%) the next most favoured choice.

Sydney-based solar design provider Pylon was the most popular design tool by a large margin, preferred by 38.3% of respondents, ahead of OpenSolar which gathered 23.4% of the votes.

Green financier Brighte was the most popular finance company with 41.3% of installers nominating it as their preferred lender, while 39.13% of respondents declared they don’t use finance at all.

Imraan Thanawalla, managing director of Solar Nerds parent company Solaris Finance, said one of the interesting finds of the survey was the industry’s attitudes on ‘buy now pay later’ products.

“There’s a lot of anecdotal evidence from the industry that people really don’t like buy now, pay later in solar but this question had installers split,” he said. “Although disapprove had the most responses, more than half are indifferent or approve.”

When asked their opinion about buy now pay later products in solar, 43.8% of installers said they disapprove of the contracts while 35.4% were indifferent and 20.8% approved.

The findings come with new laws for buy now pay later products to kick in later this year with the products to be regulated under national credit laws and companies in the sector will have to determine that products are suitable for their users under responsible lending obligations.

From 10 June 2025, providers of buy now pay later contracts will need to hold a credit licence that authorises them to engage in credit activities as a credit provider, subject to transitional arrangements.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.