Australia’s approval of renewable projects has doubled, says Plibersek

Australia federal Labor government has approved 11 new renewable energy and transmission projects in since the election in May 2022. There are currently another 95 renewable projects under assessment.

WA increases electricity supply for regional households after rule change wreaks havoc

Western Australia will now offer rural and metro-area residents in its main grid the same electricity supply. The move comes after a seemingly innocuous rule change saw regional customers unable to run their air conditioning at the same time as their cooktops – a drama pv magazine Australia first reported in July 2022 which led to sustained community pressure.

Value of Australia’s lithium exports more than triple from last year

Australia’s lithium and base metals like nickel, aluminium and copper are forecast to earn around $47 billion (USD 31.8 billion) in the current financial year, according to the Australian government’s latest forecasts.

NSW opens for big battery bids

The New South Wale government’s competitive tender for 380 MW of ‘firming’ battery capacity has now opened.

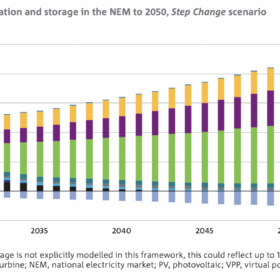

CSIRO says Australia’s storage capacity must grow tenfold, urges alternative technologies

Australia’s national science agency, the CSIRO, estimates the country could require a 10 to 14-fold increase in its electricity storage capacity between 2025-2050. It has released its energy storage report, forecasting demand in different sectors and summarising storage technologies.

Rooftop solar hit new record this summer

Household’s rooftop solar supplied a record 14% of Australia’s electricity this summer – contributing more than brown coal, and more than large-scale wind or solar farms.

PV Expo 2023: Japanese solar’s struggle for space

PV Expo and the wider Smart Energy Week wrapped up in Tokyo last week. It revealed ambitious plans for solar and energy storage installations in Japan, including creative approaches to dealing with a severe lack of space for new installations, which should bring plenty of opportunities for domestic and international players.

Investment ‘boom’ in Australia sees utility-scale jump 50%, puts targets within reach

New investment in solar and wind hit a record 7.1 GW in Australia in 2022, with the Clean Energy Regulator reporting a 50% increase in large-scale projects reaching final investment decision compared to 2021. In total, 5.3 GW of new renewable energy capacity was added to the grid in 2022, according to the Regulator’s State of Renewables report.

Europe to launch hydrogen auctions

The European Commission says it will set up the new European Hydrogen Bank by the end of this year, with additional plans to hand out 10-year contracts in a new hydrogen auction. Meanwhile, Fortescue Future Industries is setting up a project in Kenya.

Australian rooftop solar hits 20 GW

Australia’s rooftop solar capacity has passed the 20 GW threshold, according to analysis from solar consultancy SunWiz. Solar will subsequently overtake coal-fired capacity in April, when a New South Wales coal power station closes – making PV the country’s largest power generator.