Inverter suppliers go digital

More than 11 million PV inverters will be shipped in 2019 alone, and most of these will be connected to a software platform and controlled by the inverter companies. This creates an opportunity for suppliers to create new models and revenue sources, writes Cormac Gilligan, research and analysis manager at IHS Markit. And indeed, in recent years inverter suppliers have been rapidly developing ‘Internet of things’ software platforms to take advantage of this.

Cost reduction-per-kWh reduction “completely transforms” PV industry

Maximilian Schurade, Director of Technical Marketing Support at Hanwha Q Cells shares his thoughts on the solar industries current trends and challenges ahead of speaking at this year’s Smart Energy Conference and Exhibition in Sydney.

Global cumulative PV capacity tops 480 GW, IRENA says

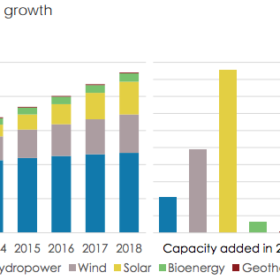

New global PV additions reached 94.2 GW in 2018, according to the International Renewable Energy Agency (IRENA). Asia is the region with the largest share of cumulative PV capacity, with around 274.6 GW, followed by Europe and North America with 119.3 GW and 55.3 GW, respectively.

More than a half million pumped-hydro sites for a world of 100% renewables

A recent Australian National University study shows that newly developed geographic information system algorithms can identify prospective sites for off-river pumped hydro projects throughout the world. The researchers, who identified around 530,000 potential sites, said pumped-hydro installations could enable large-scale energy time-shifting, as well as a range of ancillary services such as frequency regulation, which could help to integrate high levels of PV and wind into electricity systems.

Strategies vary, but the goal remains the same

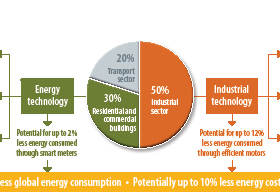

It’s no secret that global energy demand continues to rise, with some estimating an increase of a third by 2040. Meanwhile, writes David Green, Research & Analysis Manager for Smart Utilities Infrastructure at IHS Markit, the energy industry is on the cusp of a 100 year change away from oil and coal hydrocarbons towards renewables and natural gas. Every stakeholder in the industry has a role to play in the energy transition, including within the industrial sector which accounts for 50% of global energy consumption.

LCOE for li-ion batteries has fallen to $187/MWh — BloombergNEF

Lithium-ion batteries are increasingly posing a competitive threat to coal- and gas-fired generating plants when paired with solar and wind projects in a number of markets throughout the world, without the need for subsidies, according to new research by BloombergNEF (BNEF).

High-efficiency solar module upgrades from REC and Trina

REC Group has begun production of its residential N-Peak Black series, reaching up to 325 watts. Concurrently, Trina Solar has released four new modules within its Tallmax, Duomax, Duomax Twin and Honey series — some of which reach up to 415 watts.

JinkoSolar shipped 11.4 GW of modules in 2018

Chinese module manufacturing giant JinkoSolar today published its financial results for the full year 2018. While the company achieved an impressive 16% growth in shipments over the previous year, its total revenue took a 5.4% hit compared to 2017, thanks to falling module prices throughout the year.

Canadian Solar’s PV module shipments surpass 6.6 GW in 2018

Canadian Solar recorded net income of $237.1 million in 2018, from $99.6 million a year earlier, on annual PV module shipments of 6.62 GW.

Rise of bifacial lifts profits for the world’s tracker companies

Things are hotting up in the tracker world as the desire to squeeze down the price per Watt of solar power intensifies. And the rise of the trackers is attracting some well-known businesses to buy their way into the field.